Take one step closer sovereignty every single week, join the DeFi Slate community below:

Listen on YouTube | iTunes | R.S.S. Feed

High Rollers:

It seems like we’ve been talking about scaling Ethereum & high gas fees for awhile now eh?

L2 this, zkRollup that…StarkWare here ‘n there.

The good news? These guys Ben & Ross understand the L2 landscape better than most & shared a helluva lot of great info with us on this episode.

The bad news? We only did 40 mins of recording…feel like we could’ve gone on for hours!

In this episode we dive into what DeversiFi is, how L2 scaling is happening right now, StarkWare, where the major fundamental changes are taking place in the space currently & much, much more!

Grab your popcorn & enjoy y’all 🤠

-Andy

🎙DeFi by Design EP. #10: L2 DEX Scaling with Ben & Ross From DeversiFi

In case you missed this week’s Tap In Tuesday guest post from DeversiFi:

Guest Post: Ben Wilson, Marketing at DeversiFi.

I’m head of communications and marketing at DeversiFi | Nectar. I’ve been with the core team since most of us were working at Ethfinex (from 2017) where we developed novel DeFi technologies including hybrid DEX architecture, token utilities a la liquidity mining, distributed governance and many other cool things. Before this, I founded a start-up called IDEZY which sought to create the world’s first digital proof of age mobile app, disrupting an age-old (pun intended) industry. Outside of crypto, I am a big fan of traveling and have an attachment to either eastern bloc countries or tropical hideaways –– polar opposites, right.

What is DeversiFi?

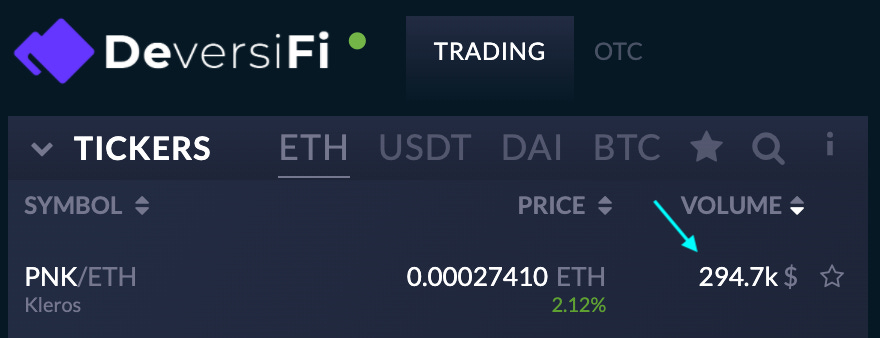

DeversiFi is a self-custodial trading ecosystem built with serious traders in mind. By serious traders, we mean those who trade for profit and trade frequently, e.g. algorithmic, arbitrage, quant or day traders.

From research, we learned that these traders are interested in DeFi technologies for the increased security and control (among other benefits) but fundamentally won’t move over from their existing venues unless they get the same level of experience on key operational must-haves — liquidity, privacy, speed, low-fees, advanced order types, etc.

DeversiFi offers CEX-like trading capabilities within their DEX.

That philosophy went into building the DeversiFi ecosystem and we’re on a mission to provide this experience along with the additional benefits that make moving over attractive –– such as withdrawal-time-certainty, insured and publicly audited contracts, as well as the unique benefits that come from the ecosystem’s native Nectar token (fee discounts, governance, rewards and much more).

In a nutshell, the DeversiFi | Nectar protocol is a Layer 2 exchange ecosystem, designed to empower both professional and retail traders in a sacrifice-free way while offering unique advantages through self-custody and the Nectar token. DeversiFi | Nectar will soon launch an extended and detailed public roadmap that will delineate our plans for the coming year.

What is StarkWare?

StarkWare is the Layer 2 scaling partner of DeversiFi. StarkWare is led by perhaps the worlds’ only experts in Stark-based scaling technology and have support and recognition from various key brands in the industry.

As aforementioned, DeversiFi is targeting professional traders who, among other things, require an exchange to be fast, private and low-cost. Building on Layer 1 makes offering these key points impossible. While we were able to solve liquidity issues on version 1.0 (by bridging liquidity) we were unable to offer the rest. With this in mind, we joined forces with the StarkWare team to incorporate their technology with the goal of scaling DeversiFi on Etheruem L2, dramatically reducing cost, and increasing speed.

There are currently various L2 options in existence, all of which offer a slightly different set of advantages, Loopring’s SNARK-based exchange being a prime example. But there are 2 leading reasons why we chose StarkWare’s Validium approach –– privacy and speed.

Many L2 technologies effectively solve key Ethereum issues such as speed and gas-costs but they don’t strictly offer the privacy element. And without privacy, people can view the transaction history of any given trader. While we agree with the openness and transparency of DeFi, most professional traders won’t trade on venues where their trades can be monitored, and their strategies reverse engineered or intercepted.

The next point is speed. Using Validium, DeversiFi is theoretically able to handle 9,000+ transactions per second (more than VISA). This, admittedly, isn’t super important as we’ve yet to reach the demand (we’re still growing and while the space as a whole is still growing) but this speed superiority certainly leaves the road wide open for growth in throughput to be unhindered.

L1 vs. L2 Scaling

The great thing about Ethereum is that it’s permissionless and open to everyone. There is no benevolent or evil gatekeeper. If you have the will, you can build on Ethereum and deliver products that your community wants to use. This makes ideology somewhat redundant, and I think that’s a great thing. That said, there are some obvious values that sit at the heart of the wider blockchain/ethereum movement and those are decentralisation (empowering groups to coordinate and collaborate at scale), and unstoppability/censorship resistance (the inability to arbitrarily deny services or access to people for any reason).

The CEO of DeversiFi and founder of Nectar, Will Harborne, illustrates the scaling potential of decentralisation (through DAOs) quite well in his talk at DAOfest. In short, truly distributed groups have traditionally been limited to approximately 5,000 members or usually much less (similar to what many researchers have identfiied as the maximum number of people workable in direct democracy). This was the case with the NYSE which began as a collective of traders (we would call it a DAO today) and grew to a hard cap of 1366. The blockchain allows groups like this to surpass these low caps and become scalable, autonomous organisations, enhanced by unstoppable smart-contracts and secured by the blockchain. That is part of the vision at necDAO & DeversiFi.

Since inception, Ethereum has moved at ridiculous pace. It’s like, every year there is a new innovative movement: DAOs, Defi Protocols, Yield Farming, Social Tokens, all sorts of ways to democratise value and information. It’s pretty easy to see how this is going to be a significant part of the future.

“Most of it has been built on L1 and L2 is actually very new thoughI see L2 as being a temporary solution to Ethereum until we have ETH 2.0 live and operational at which point I imagine most L2 dapps will move over”

Conclusion

In sum, we believe there is large influx of professional traders waiting to adopt decentralised finance in a way that works for them. Simply put, self-custody advantages and protection against (fear of) hacks isn’t enough, especially as CEX become more sophisticated in dealing with such events. For DeFi exchanges to attract these users, they need to:

a) offer the same experience (without sacrifice),

b) offer additional advantages and

c) be operational for a long enough time to become trusted and credible.

Changing behaviour takes time and patience, along with lots of hours building, researching and ensuring you are offering a product that people want.

As a team, we have been building DeFi for almost 4 years now, surviving the crypto winter, and can boast pioneering the earliest liquidity mining token (Nectar) as well as the first hybrid DEX (Ethfinex Trustless) to solve the old liquidity problem (by bridging orderbooks using 0x).

We’ve been around a while and have an exciting roadmap of features and plans ahead. We’d love to have you with us!

🗣Join the DeversiFi Discord now!

✅Follow the team on Twitter!

📈Make your first trade on their website!

🔥Head over to their Dapp to make your account!

🚀Look at the Nectar token on CoinGecko!

📈 Shoutout To Our Partner: MCDEX— trade the first ever decentralized ETH & LINK perp swap contracts on MCDEX.

🙏 New To Yield Farming? Use Akropolis to lend, borrow, and dollar-cost-average in the simplest way possible with their new Delphi mainnet launch!

👨🏽🌾Earn Interest & Leverage Your Assets with Aave, a non-custodial money market protocol leading the #DeFi charge.

FARMING OPPORTUNITY: Deposit LINK tokens into Aave to get aLINK, then head over to Yearn to put your aLINK into the yaLINK vault for extra yield (20%+ APY currently). It all starts here with Aave!

Liked this episode? Share with a friend :)

Subscribe to The Rollup Newsletter & join thousands of other crypto enthusiasts:

DeFi By Design EP #10: L2 DEX Scaling With DeversiFi